GDR Daily Perspective for Wed 19 April 2023

Following another rejected breakout, the market may be looking to sell-off

GDR Model Insights for the S&P 500

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

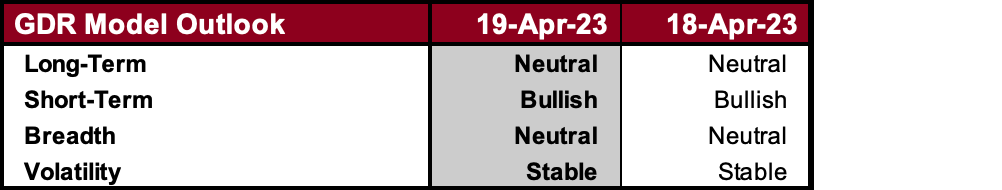

GDR Model Outlook

The overall Model is Neutral. Breadth has been switching between Neutral and Bearish. Beware of the potential for increased Volatility by the end of this week.

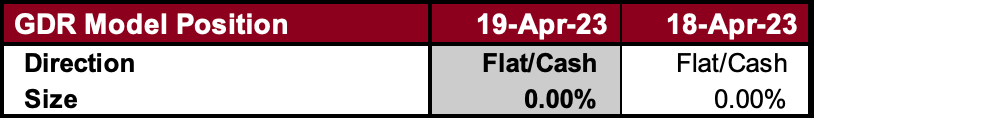

GDR Model Position

In line with the fragility of the current rally, the Model remains 100% in cash.

S&P 500 Futures Market Profile Analysis

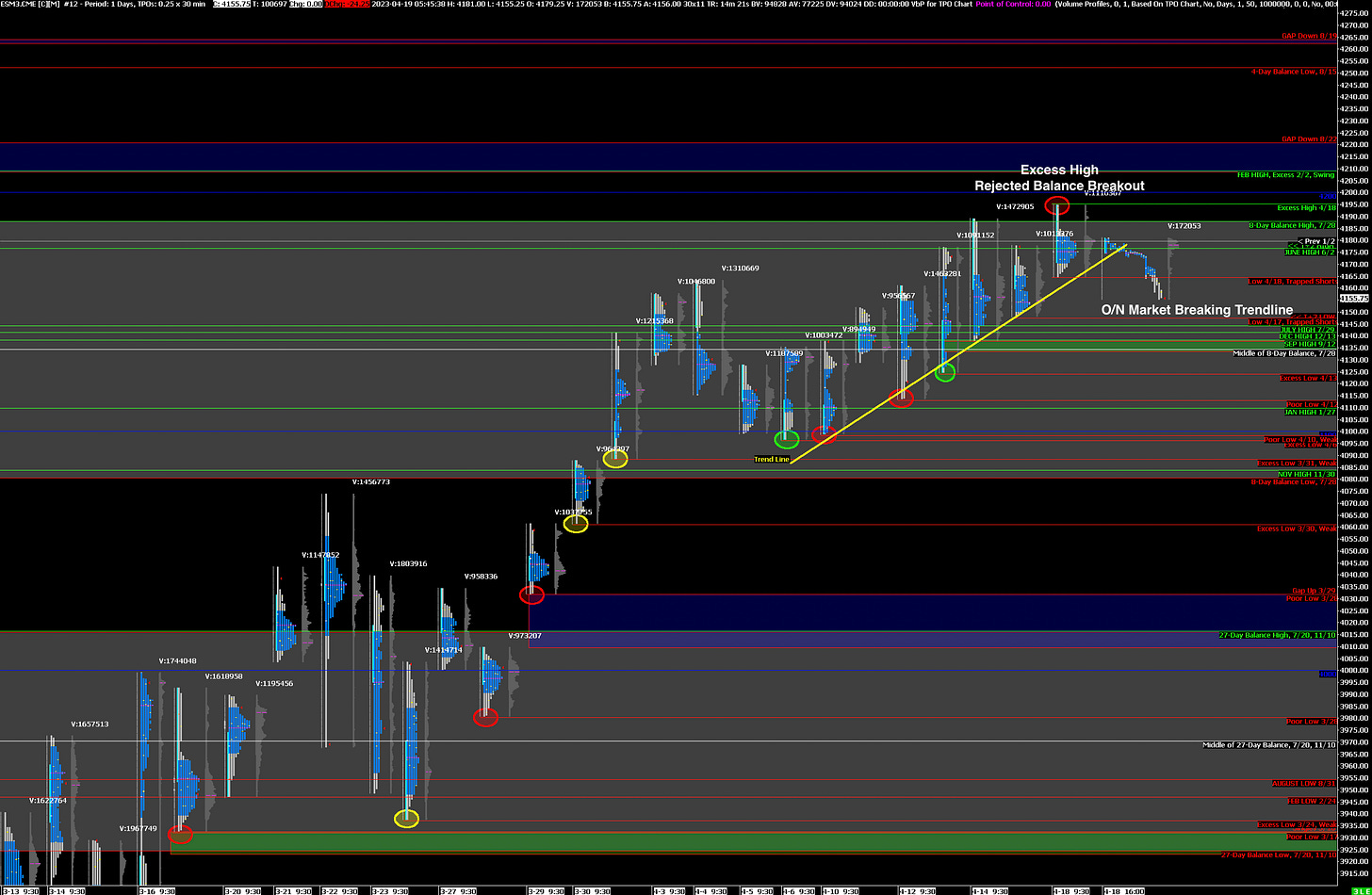

Near-Term Outlook: Bearish on Trend Line Breakdown and Rejected Balance Breakout

Alternate Outlook: Bullish following Liquidation Day, must regain Trend Line

Key Levels for Today

Bullish: 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down), 4252 (Bottom of Upper Balance Zone)

Bearish: 4148 (T+2 Settlement Low), 4134 (Trapped Short Position), 4113 (Poor Low)

Market Narrative

The ES has made 5 consecutive higher lows that almost perfectly fit a trend line. This suggests the presence of short-term Weak Hands Traders. Moreover, I have highlighted for some time that Inventories have been looking overly long. Following a second rejected breakout from the current Balance Zone, which left behind meaningful Excess on the High, the market may now be looking to sell-off in the near-term.

For the uptrend to remain intact, the market would likely have to at least regain the trend line highlighted in the chart above. Do note that the current Swing High was made in the Overnight Session, and those tend to be relatively insecure.

Economic Calendar

Today at 2:00pm - Fed Beige Book

Earnings After the Close: TSLA 0.00%↑

Later This Week: Existing Home Sales (Thu)