GDR Daily Perspective for Tue 18 April 2023

Continued Bullish Outlook Today, Spike Trading Guidelines Apply

GDR Model Insights for the S&P 500

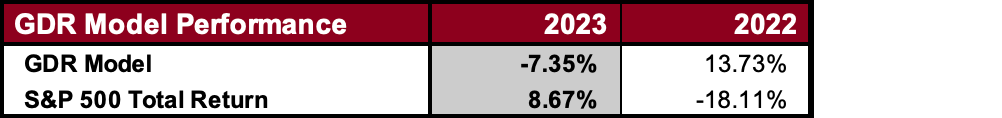

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

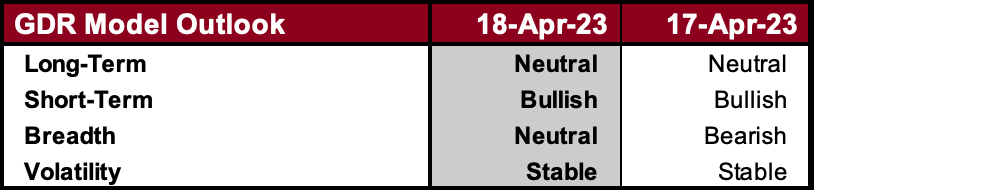

GDR Model Outlook

The overall Model is Neutral. Breadth has been switching between Neutral and Bearish. Beware of the potential for increased Volatility by the end of this week.

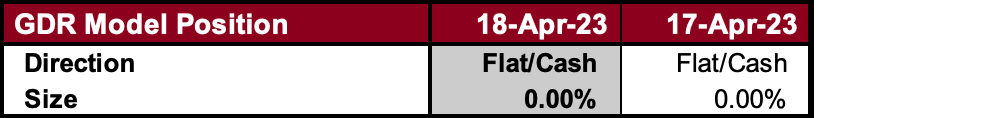

GDR Model Position

In line with the fragility of the current rally, the Model remains 100% in cash.

S&P 500 Futures Market Profile Analysis

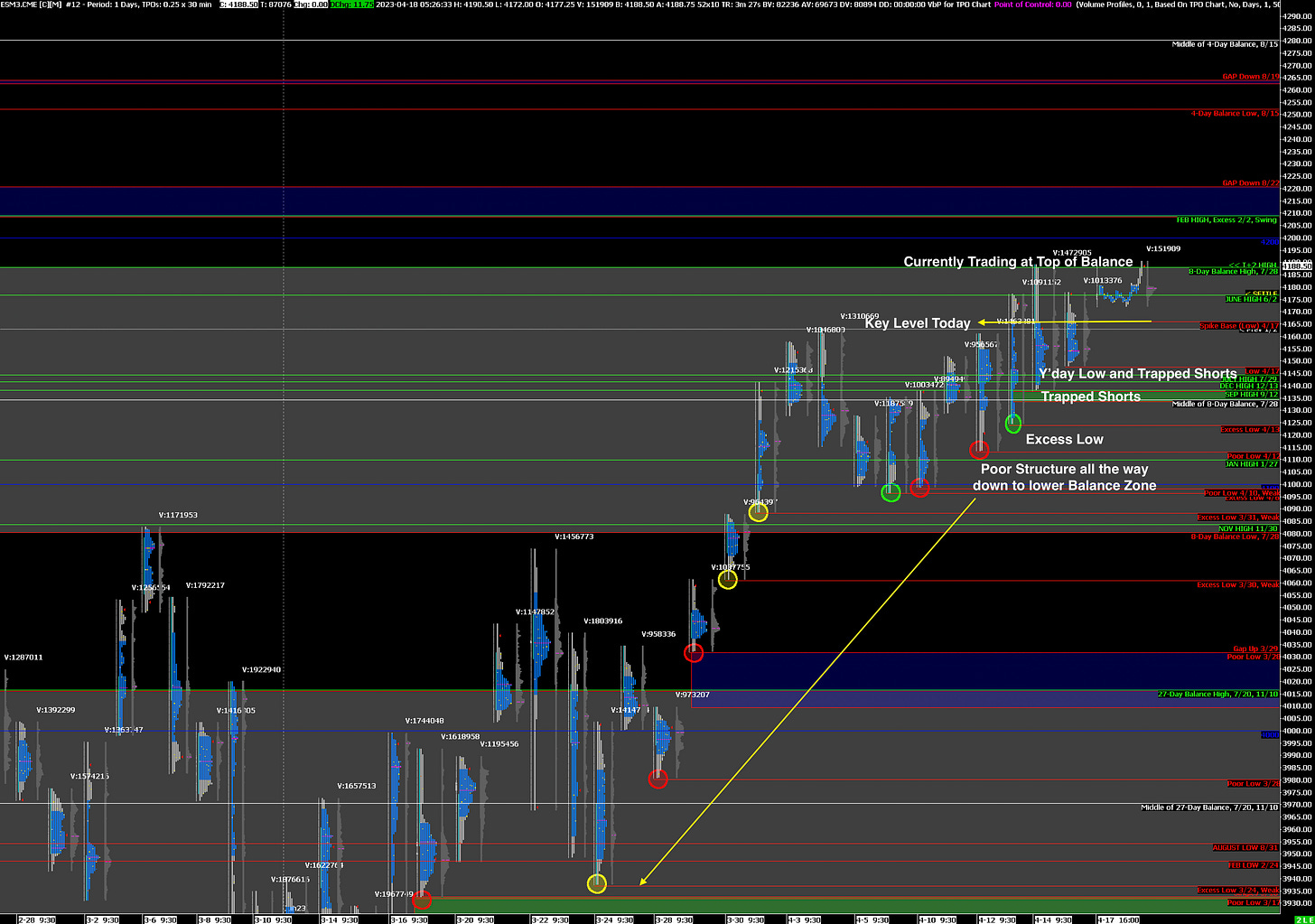

Near-Term Outlook: Bullish, Spike Trading Guidelines apply

Alternate Outlook: Second Rejection of Current Balance Zone Breakout

Key Levels for Today

Bullish: 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down), 4252 (Bottom of Upper Balance Zone)

Bearish: 4164 (Short-Term Breakout Level, Y’day Spike Base), 4147 (Y’Day Low and Trapped Short Position), 4134 (Trapped Short Position)

Market Narrative

Yesterday the market opened into a modest Liquidation that Trapped Shorts at the lower prices. This should make yesterday’s Low relatively secure going into today and the near-term outlook remains Bullish. Spike Trading Guidelines apply and judging from the Overnight trade as of now, the market seems set to open in the most Bullish scenario.

The market is currently trading around the Top of the Current Balance Zone so remain alert for another potential Breakout Rejection. In this scenario, the market would likely have to auction lower before continuing up.

Economic Calendar

Earnings Before the Open: BAC 0.00%↑, GS 0.00%↑

Today at 8:30am - Building Permits

Today at 1:00pm - FOMC Member Bowman Speaks

Later This Week: TSLA 0.09%↑ Earnings (Wed), Existing Home Sales (Thu)