GDR Daily Perspective for Tue 11 April 2023

Bullish, but Inventories seem overly Long

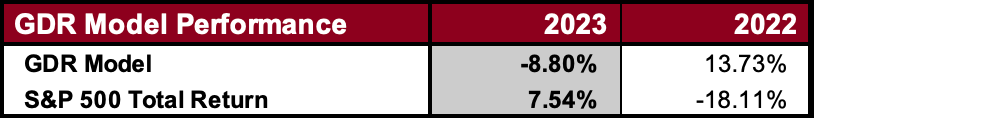

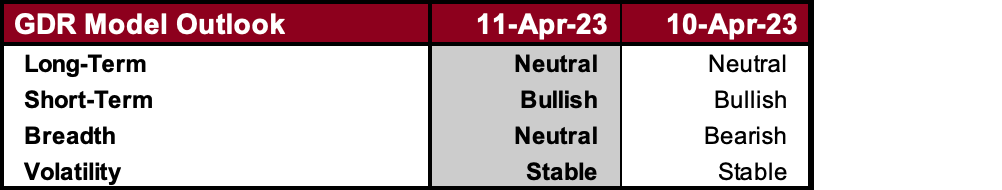

GDR Model Insights for the S&P 500

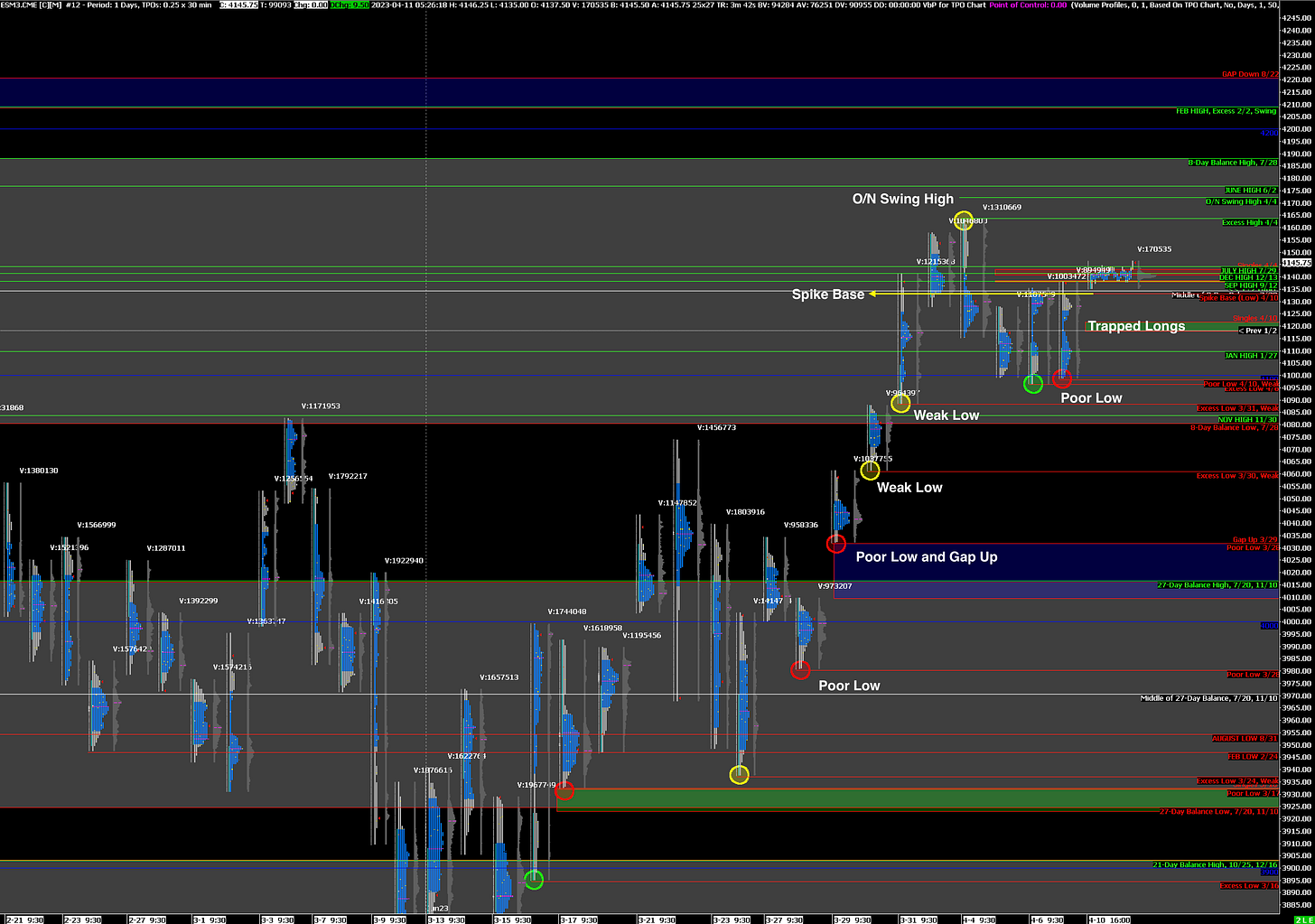

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Bullish pending participation of longer timeframe

Alternate Outlook: Liquidation Break on Overly Long Inventories

Key Levels for Today

Bullish: 4143 (Trapped Long Position), 4172 (O/N Swing High), 4188 (Top of Current Balance Zone)

Bearish: 4133 (Y’day Spike Base), 4118 (Closes Double Distribution), 4098 (Y’day Poor Low)

Market Narrative

Yesterday the market was once again dominated by weak-hands traders as suggested by the Poor Low left behind. The day closed on a Spike Higher that for now seems to have been accepted in the Overnight session. Spike Trading Guidelines apply heading into today, however I would expect more Balanced day as the market awaits key CPI data tomorrow. Note that a Balanced day today doesn’t negate Bullishness in the near-term.

Finally, don’t overestimate the potential for a Liquidation Break, especially since Value didn’t move higher with price yesterday. It doesn’t seem like the higher probability outcome, but if Inventories are indeed overly long, there’s a fair chance that traders may want to reduce risk ahead of tomorrow’s data release.

Economic Calendar

Today at 1:30pm - FOMC Member Goolsbee Speaks

Later this Week: CPI (Wed), FOMC Meeting Minutes (Wed), PPI (Thu), Retail Sales (Fri)