GDR Daily Perspective for Thu 20 April 2023

The market seems to be running out of upside, poor structure below raises the odds of liquidation

GDR Model Insights for the S&P 500

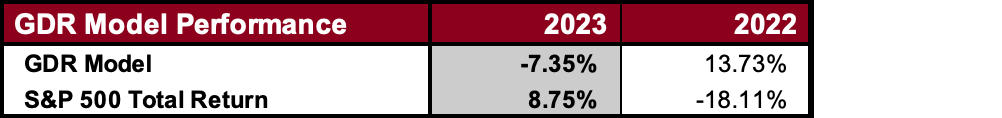

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

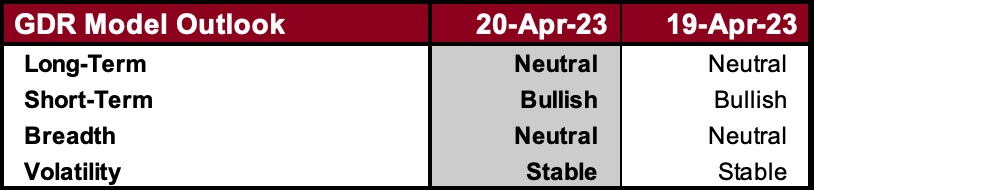

GDR Model Outlook

The overall Model is Neutral. Breadth has been switching between Neutral and Bearish. Beware of the potential for increased Volatility by the end of this week.

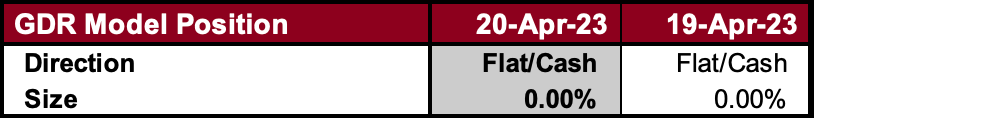

GDR Model Position

In line with the fragility of the current rally, the Model remains 100% in cash.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Bearish on Trend Line Breakdown and Rejected Balance Breakout

Alternate Outlook: Balance on Unchanged Value

Key Levels for Today

Bullish: 4165 (T+2 Settlement Low), 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down)

Bearish: 4148 (4/17 Low, Trapped Short Position), 4134 (Trapped Short Position), 4113 (Poor Low)

Market Narrative

For the third time in four days the market rejected breakout from the current Balance Zone and left behind an Excess High. A Poor Low was also made early on yesterday. It certainly starts to look like the Weak Hands that have dominated the market over the last several weeks are running out of upside. If that’s the case, the odds of a more serious Liquidation are relatively high.

The odds of a rally today seem negligible to me. However, I did note that despite the Gap lower yesterday, the market traded back to Unchanged Value. Finally, it seems we are likely to open on another Gap Down today. If we do Gap Trading Guidelines apply.

Economic Calendar

8:30am - Initial Jobless Claims, Philly Fed Manufacturing Index

10:00am - Existing Home Sales

12:00pm - FOMC Member Waller Speaks

3:00pm - FOMC Member Bowman Speaks