GDR Daily Perspective for Thu 13 April 2023

The market remains in Balance but the potential for further Liquidation keeps growing

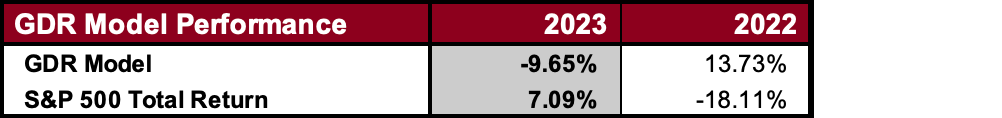

GDR Model Insights for the S&P 500

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Balanced with potential for further Liquidation

Alternate Outlook: Value continues to trend higher

Key Levels for Today

Bullish: 4138 (Y’day Halfback), 4178 (O/N Swing High), 4188 (Top of Current Balance Zone)

Bearish: 4113 (Y’day Poor Low), 4098 (Poor Low), 4080 (Bottom of Current Balance Zone)

Market Narrative

Yesterday the market opened on a Gap Up following the CPI data release, but it was quickly filled as the town for the day turned more Bearish. Focusing on price action alone, yesterday seemed quite Bearish, but note that Value failed to build lower - carry this into today’s trading. The implication is that while Inventories still seem overly Long, the market hasn’t definitively tipped over to Bearish mode at this point.

Generally (though not always) for an Inventory correction to begin, a catalyst is required. Be mindful of PPI and Employment data coming out today at 8:30am.

Economic Calendar

Today at 8:30am - PPI, Initial Jobless Claims

Tomorrow: Retail Sales