GDR Daily Perspective for Mon 17 April 2023

Bullish after Friday's Liquidation Break

GDR Model Insights for the S&P 500

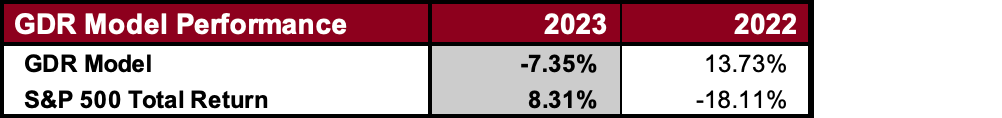

GDR Model Performance

The Model managed to eke out a modest 1.82% gain last week. This year’s has been challenging for the Model’s style due to low confidence in the market.

GDR Model Outlook

The Long-Term Outlook remains Neutral now for the third week in a row and Breadth is Bearish. This along with the Bullish Short-Term Outlook suggests that Long trades should not overstay their welcome. Beware of the potential for increased Volatility by the end of the week.

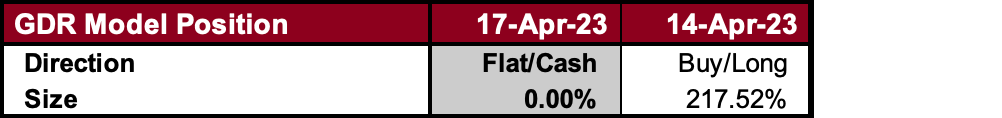

GDR Model Position

In line with the fragility of the current rally, the Model has closed its Long position and is now 100% in cash to start the week.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Bullish after Friday’s Liquidation Break

Alternate Outlook: Potential for Selling after Rejected Breakout of Balance

Key Levels for Today

Bullish: 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down), 4252 (Bottom of Upper Balance Zone)

Bearish: 4164 (Short-Term Breakout Level, Y’day Halfback), 4124 (T+2 Settlement Low), 4113 (Poor Low), 4098 (Poor Low)

Market Narrative

The market attempted a Breakout from the current Balance Zone almost immediately after the open but was Rejected. This resulted in a Liquidation Break allowing for much needed Inventory adjustment. Even though Value failed to move higher, the market repaired all but one of the sets of Single Prints from Thursday’s relentless rally. On balance, this makes the market Bullish going into today and another attempt to Breakout of the Current Balance Zone is likely.

Should that attempt fail again, then watch out for the potential for more Liquidation. Sometimes markets have to break before they can head higher. The key to reading whether this will happen likely lies in figuring whether the market can trade and Accept below Friday’s Halfback. Keep in mind that Structure below remains poor.

Economic Calendar

Today at 8:30am - NY Empire State Manufacturing Index

Later This Week: Building Permits (Tue), TSLA 0.00%↑ Earnings (Wed), Existing Home Sales (Thu)