GDR Daily Perspective for Mon 10 April 2023

Market is in Balance going into key data week and start of earnings

GDR Model Insights for the S&P 500

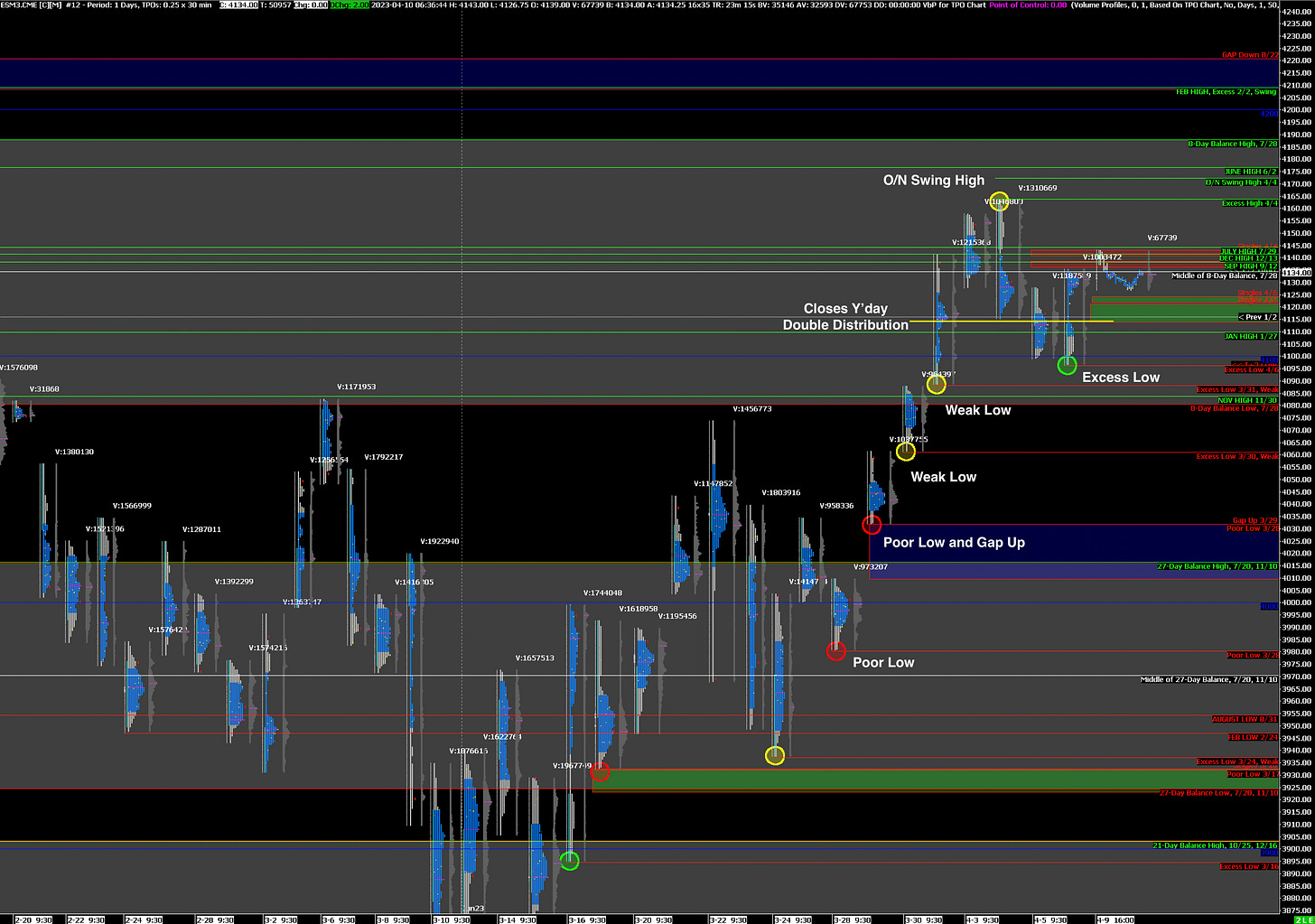

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Balanced, could go either way (see below for Key Levels)

Alternate Outlook: N/A

Key Levels for Today

Bullish: 4143 (Trapped Long Position), 4172 (O/N Swing High), 4188 (Top of Current Balance Zone)

Bearish: 4114 (Trapped Short Position), 4098 (Y’day Poor Low), 4088 (Weak Low)

Market Narrative

Last Thursday the market rallied halfway through the trading day frontrunning the employment report on Friday. Employment numbers were released on a market holiday, but the ES rallied on the release during the Globex session. Going into today and this week the market looks Balanced and can break in either direction.

While the CPI and FOMC Meeting Minutes releases will be in focus, it’s important to keep in mind that Market Structure suggests that short-term Inventories are likely overly long and thus the risk of Liquidation Breaks is higher than average.

Economic Calendar

Today at 4:15pm - FOMC Member Williams Speaks

Later this Week: CPI (Wed), FOMC Meeting Minutes (Wed), PPI (Thu), Retail Sales (Fri)