GDR Daily Perspective for Fri 14 April 2023

Market attempting Breakout from Balance

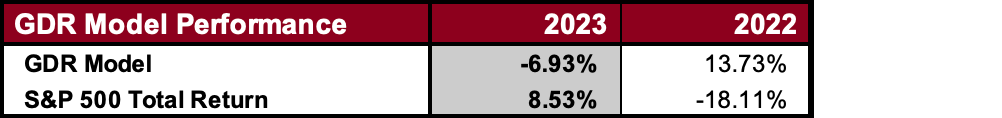

GDR Model Insights for the S&P 500

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Attempting Bullish Breakout of Balance

Alternate Outlook: Rejection of attempted Breakout of Balance

Key Levels for Today

Bullish: 4178 (O/N Swing High), 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down)

Bearish: 4164 (Short-Term Breakout Level), 4151 (Y’day Halfback), 4113 (Poor Low), 4098 (Poor Low)

Market Narrative

Yesterday the market trended higher relentlessly - I would argue the ES one-timeframed higher all day long even though technically it stopped in the last 30 minute period. This left behind 4 sets of Single Prints and the Structure is now looking stretched on the upside. Nonetheless, the trend is clearly higher and the market is preparing to Breakout of Balance. This is happening on a longer timeframe, but you can apply Balance Trading Guidelines all the same.

Do note that this year the market has struggled with breaks from Balance higher and lower so the potential for Rejection is there. Should that happen, the potential target for the Short trade is the Low of the Balance Zone at around 4080. Don’t fight the trend, but at the same time, remain aware of its likely fragility.

Economic Calendar

Earnings Before the Open: JPM 0.00%↑, C 0.00%↑

Today at 8:30am - Retail Sales

Today at 8:45am - FOMC Member Waller Speaks

Today at 9:15am - Industrial Production

Today at 10:00am - Michigan Consumer Sentiment, Business Inventories

Next Week: Building Permits (Tue), Existing Home Sales (Thu)