ES Futures Daily Update - Wed 26 Oct 2022

The market has headed higher on good structure and GDR Model is showing initial signs of bullishness

GDR Model Update

GDR Model Performance (2022): +24.56%

Market Tone: Bearish

Positioning: -50.00%

Commentary: The GDR Model has shown some signs of bullishness today. Moreover, in the last couple of days, market breadth and gamma exposure as measured by the GEX index have been a lot more in line with what is usually seen in a more bullish market. Although we’re still quite a ways away from Market Tone definitively turning Bullish, this week will likely be critical in determining the tone for November.

Short-Term ES Market Structure Update

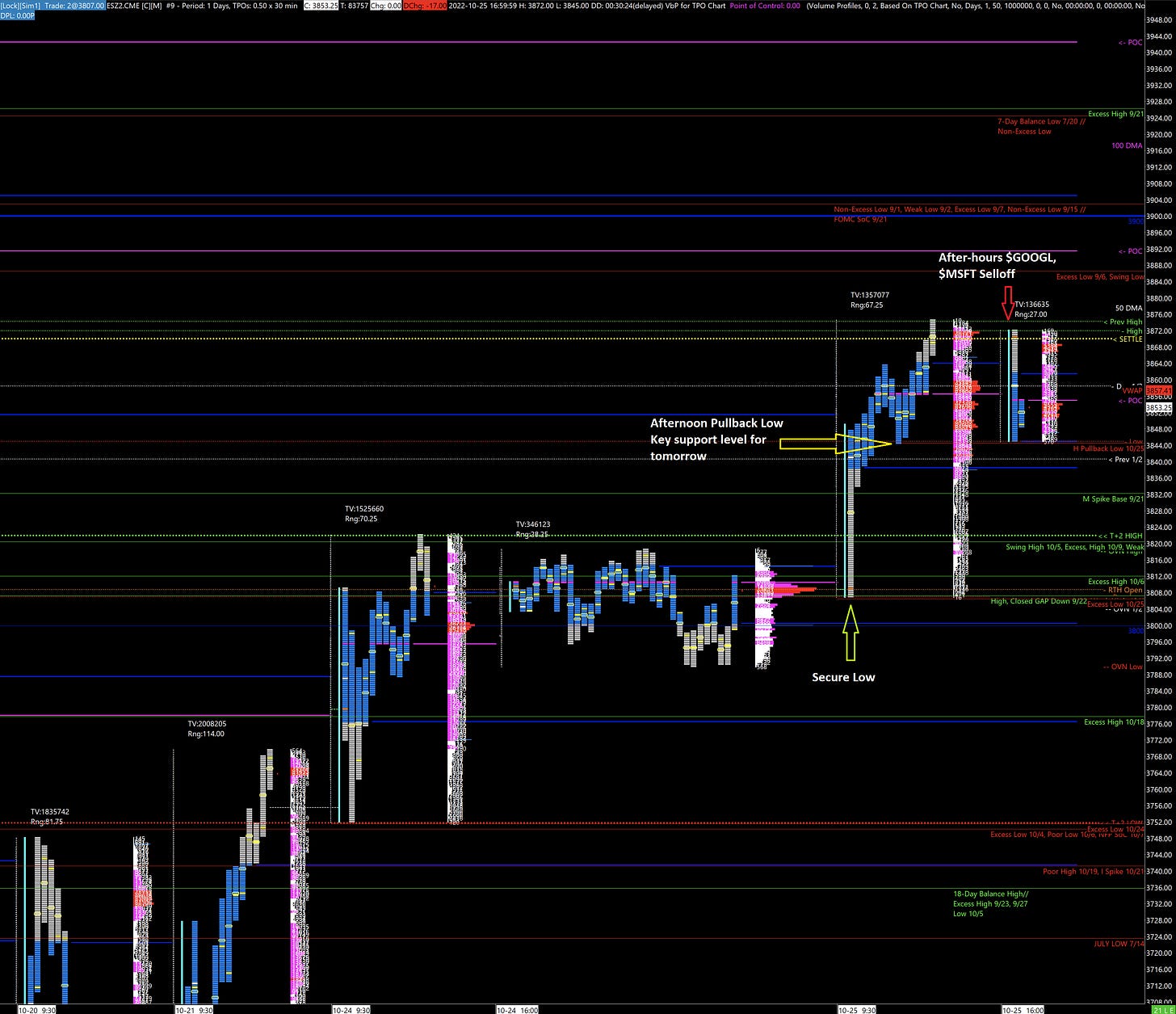

In yesterday’s update, I wrote “As of now, there are better odds that ES futures continue going up in the near-term." When the market was up nearly 70 points at the day’s high, I tweeted caution in carrying long positions overnight due to MSFT 0.00%↑ and GOOGL 0.00%↑ earnings. The announcements caused ES futures to give up 20 points.

Nonetheless, today the ES put in another strong low at the open and market structure remains supportive of further upside. The more reasonable near-term expectation is for ES futures to take out the 3900 area, which is not only a round number but also coincides with the start of the most recent drop from the September FOMC announcement. The immediate key level to watch is today’s afternoon pullback low at 3844.50, which should provide support if the market remains bullish near-term.

After that, assuming market structure and inventory continue to be supportive, the ES has a chance to tackle poor structure left behind between ~3980 and ~4220, which includes two gaps lower from late August and early September.

Potential Market-Moving Events

08:30am - Goods Trade Balance (Sep), Retail Inventories (Sep)

10:00am - New Home Sales (Sep)

Earnings (After Close): META 0.00%↑