ES Futures Daily Update - Thu 27 Oct 2022

Weak high and weak low today - what to expect next

GDR Model Update

GDR Model Performance (2022): +25.02%

Market Tone: Bearish

Positioning: -50.00%

Commentary: while the GDR model showed sign of initial bullishness yesterday, it has swiftly moved back to firmly bearish today. As mentioned before, the rest of this week is likely critical in determining where GDR’s Market Tone heads next as a shift to Bullish is still possible.

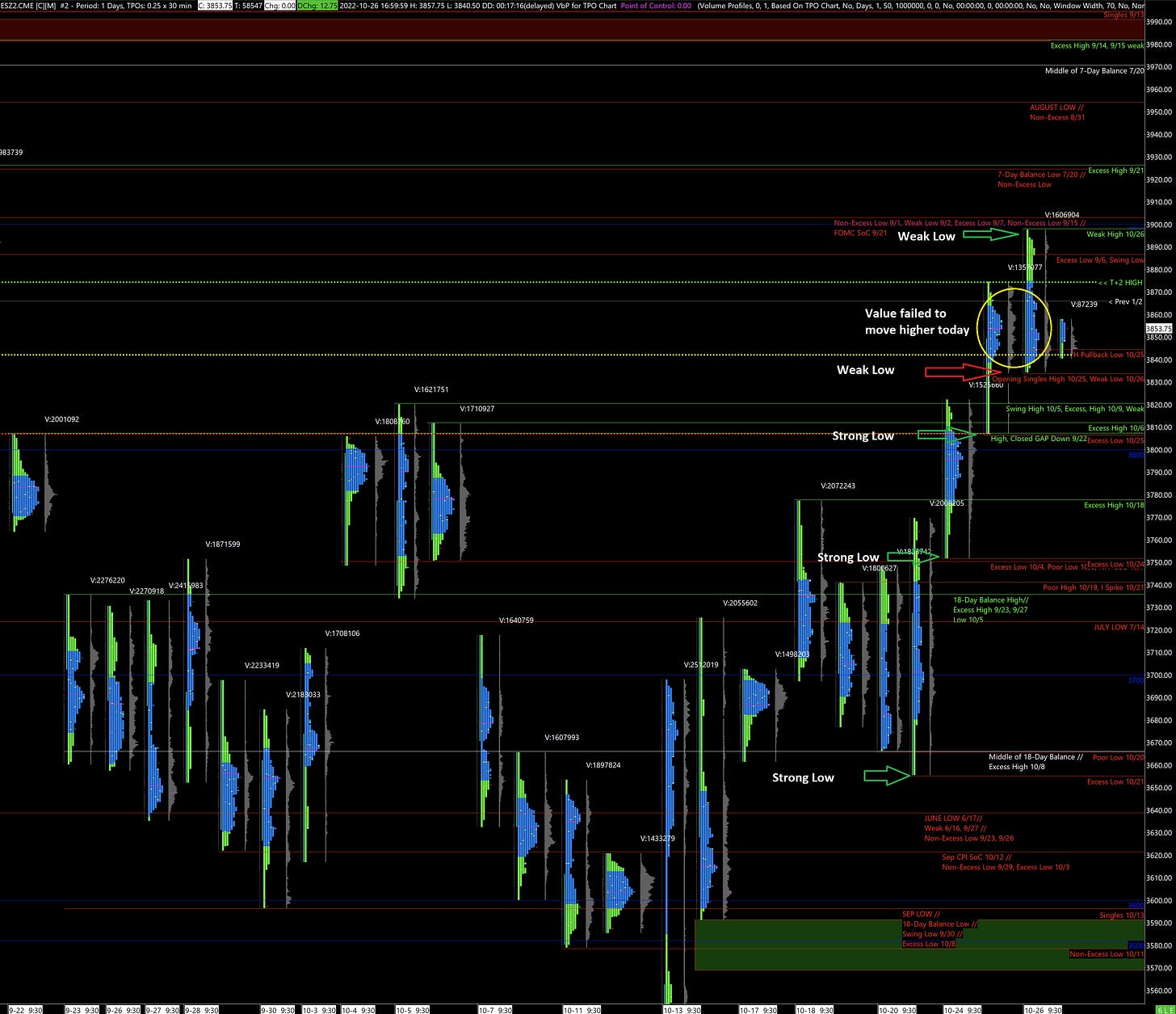

Short-Term ES Market Structure Update

ES futures have recently put in 4 strong lows that should be considered secure for now. Today, the ES opened strong and reached just 2 points under the 3900 mark after which it sold off for the rest of the day. Note that: value failed to follow price higher in the morning rally and that today’s high is weak. Because of the exacting level where the sell off started - just short of a round number and the start of the September FOMC drop - it suggests weak hands, momentum selling.

Likewise, today’s low is also weak because it stopped just short of yesterday’s opening rally single prints. Weak highs and lows are more likely to be revisited sooner than strong lows. Therefore I will consider the 4 strong lows put in on 10/13 (2022 low), 10/21, 10/24 and 10/25 as secure for now, but expect both today’s high and low to be taken out before the end of the week.

If you are day trading the ES, be mindful of upcoming events that can cause drastic moves: GDP tomorrow before open, key earnings tomorrow after close, and PCE inflation data Friday before the open. For now, my baseline expectation is the ES continues higher until there’s a material change in market structure.

Potential Market-Moving Events

08:30am - GDP, Initial Jobless Claims, Durable Goods Orders

Earnings (After Close): AAPL 0.00%↑, AMZN 0.00%↑