ES Futures Daily Update - Fri 28 Oct 2022

Supply above implies the GDR Market Tone may reassert itself

GDR Model Update

GDR Model Performance (2022): +25.40%

Market Tone: Bearish

Positioning: -50.00%

Commentary: the GDR model remains firmly bearish and it will likely be difficult for a change in Market Tone to materialize anytime soon.

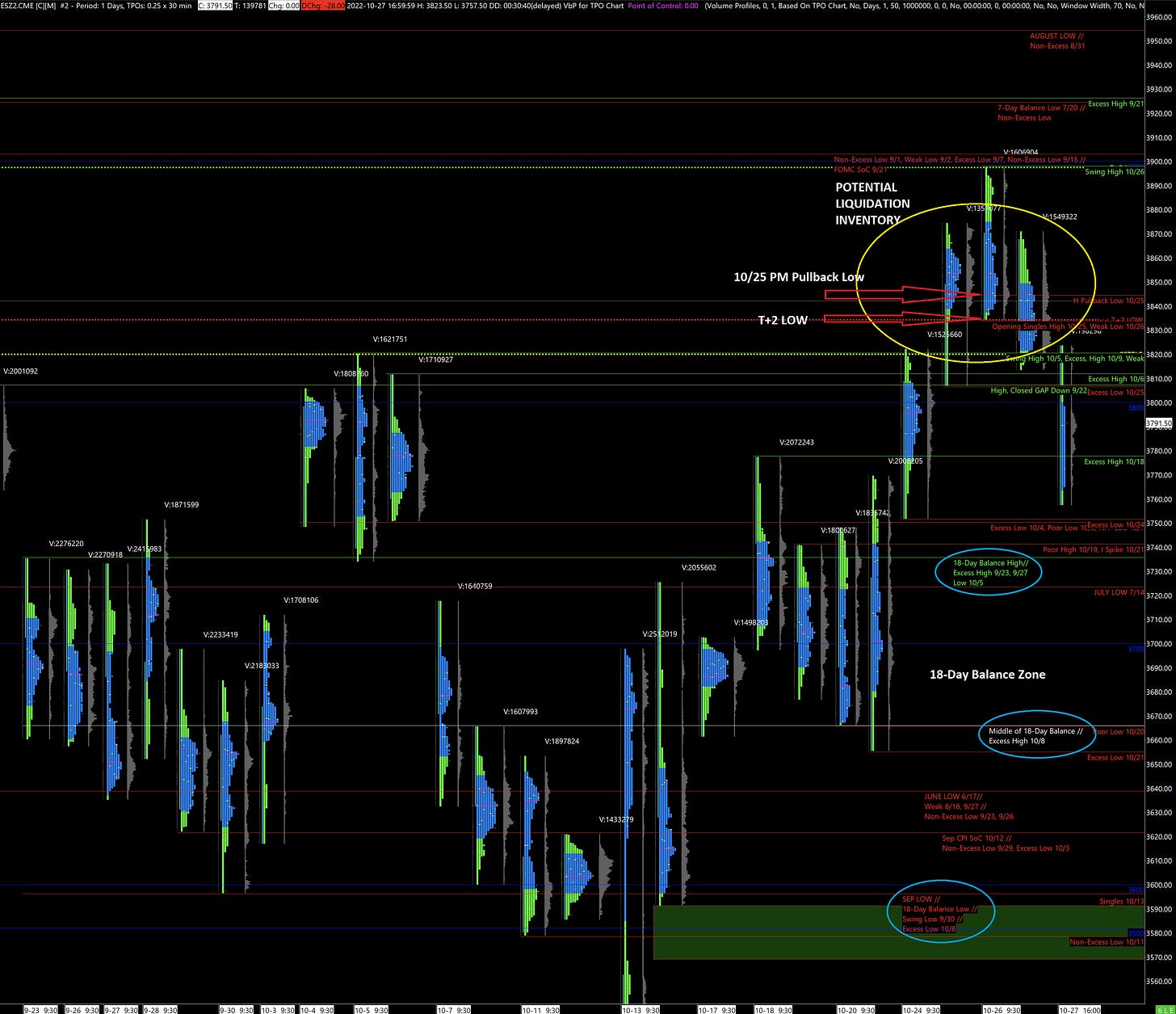

Short-Term ES Market Structure Update

As highlighted earlier this week, holding the 10/25 afternoon pullback low was key to maintain the short-term bullish trend. Today, ES futures failed to hold that level and sold off further after-hours following AMZN 0.00%↑ earnings. Now there is supply above, which can provide fuel for a sustained sell-off tomorrow. A different way to think about this is that we are breaking down from a small 3-Day Balance Zone. As usual, it’s best practice to go with any break from balance.

Barring an unexpected recovery in the overnight session tonight, a sell-off has strong potential for serious acceleration given the PCE inflation data release tomorrow morning. In addition, we are currently below the T+2 Low. Accepting below settlement tomorrow will likely mean that plenty of short-term traders are likely to be caught offside as they sit at their desks in Asia and London tomorrow.

Ultimately, the value of the longer-term GDR Model that I use to start every update is to help us stay out of potentially fickle rallies that can make it seem like the market has turned a corner. The previous 18-Day Balance Zone highlighted is now back in play. Trade carefully.

Potential Market-Moving Events

Earnings (Before Open): XOM 0.00%↑, CVX 0.00%↑

08:30am - PCE Price Index, Personal Spending, Employment Cost Index

10:00am - Pending Home Sales, Michigan Consumer Sentiment