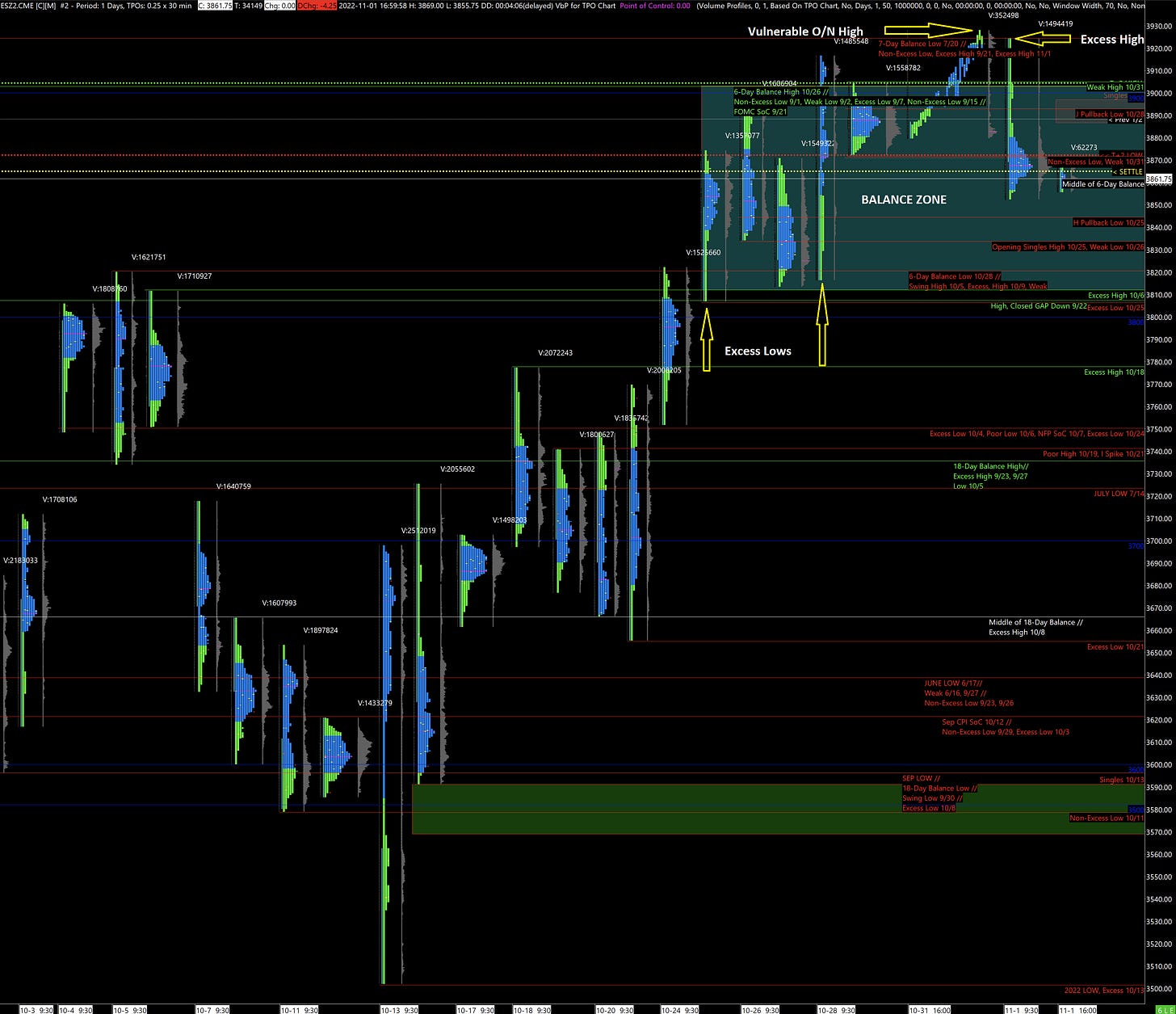

ES Futures Daily Insights - Wed 2 Nov 2022

The market is balanced heading into Fed Day - taking a position at this point would likely be a poor odds gamble

GDR Model Insights for the Week

GDR Model Performance (2022): +24.57%

Market Tone: Bearish

Positioning: -50.00% Short (previous day: -50.00% Short)

Commentary: much like Market Structure, the GDR Model is at an indecision point, likely awaiting more information from the market. At indecision points, GDR Model defaults the previously established position, which is why it remains short.

ES Market Structure Insights for Tomorrow

Had today been Fed Day, I would have been relatively confident that bears had the edge, but the US session opened into a liquidation break that corrected poor structure below from the previous 2 days. Liquidation breaks typically happen when inventories are overly long - they correct imbalanced inventories.

The ES is now back around the middle of the current 6-day Balance Zone. As of now there is only a very slight edge for long positions going into tomorrow on account of the multiple Excess Lows made recently and the poor structure at higher prices.

Nonetheless, I am flat heading into tomorrow - the edge for bulls is so razor thin this time around that the risk involved in what will almost certainly be a very volatile day is not worth it. I will wait for the market to tell me what the agenda is.

Potential Market-Moving Events Tomorrow

08:15am - ADP Employment Report

02:00pm - Fed Interest Rate Decision, FOMC Statement

02:30pm - FOMC Press Conference