ES Futures Daily Insights - Thu 3 Nov 2022

GDR's Bearish Market Tone is reasserting itself today - liquidation inventory is now above

GDR Model Insights for the Week

GDR Model Performance (2022): +26.13%

Market Tone: Bearish

Positioning: -50.00% Short (previous day: -50.00% Short)

Commentary: GDR’s Bearish Market Tone is reasserting itself - today was an emphatic rejection of the bullish idea from the last few days.

ES Market Structure Insights for Tomorrow

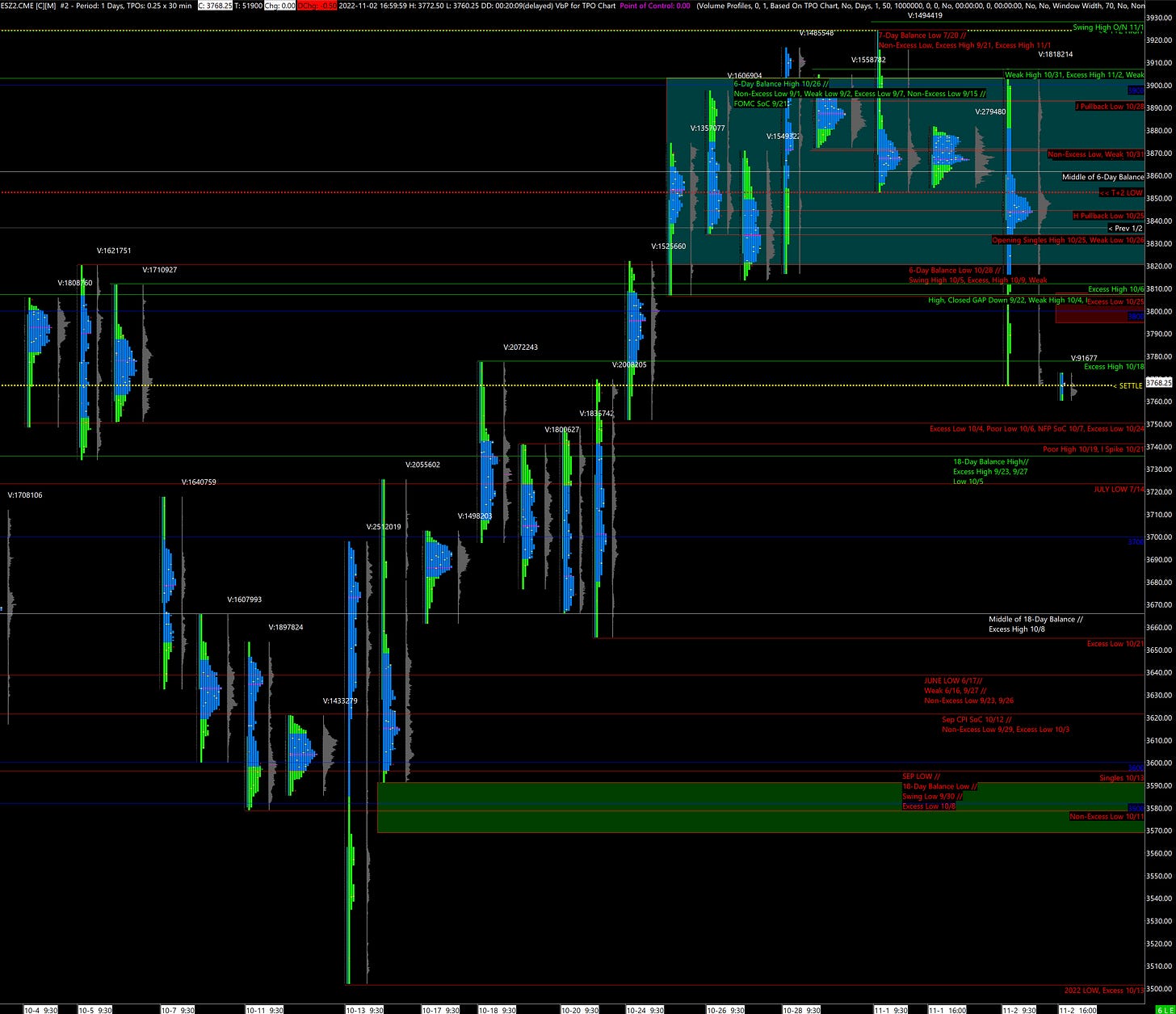

After the Fed announcement, the ES tried to breakout of the recent 6-Day Balance. The breakout was rejected and followed by a successful breakdown from the Balance Zone. This is bearish and the high of the late afternoon spike at around 3810 now becomes a key level.

If tomorrow the ES opens around or below today’s settle it is another bearish sign. For the ES to return to a bullish tone it has to take out today’s spike base at 3810 and re-enter the previous Balance Zone from its low at 3820.

There is still more key data coming out with Initial Jobless Claims tomorrow and Unemployment on Friday, but for now assume bearish until the market proves otherwise.

Potential Market-Moving Events Tomorrow

08:30am - Initial Jobless Claims, Nonfarm Productivity, Unit Labor Costs, Trade Balance

09:45am - S&P Global Composite PMI, Services PMI

10:00am - ISM Non-Manufacturing PMI, ISM Non-Manufacturing Employment, Factory Orders