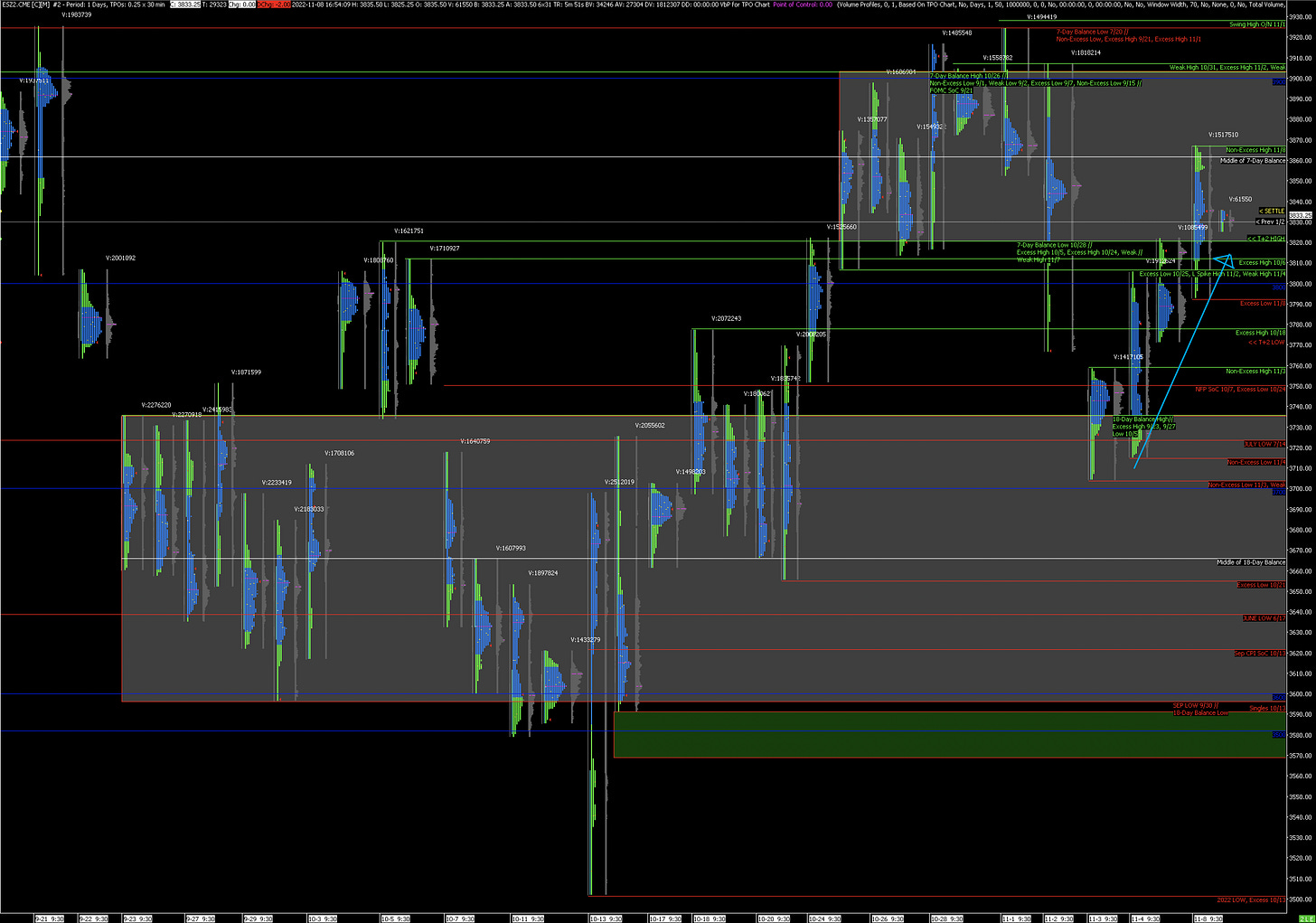

ES Futures Daily Insights for Wed 9 Nov 2022

GDR holding onto initial bullishness while value has moved higher

GDR Model Insights for the Week

GDR Model Performance (2022): +24.98%

Market Tone: Bearish (previous week: Bearish)

Positioning: -50.00% Short (previous day: -50.00% Short)

Commentary: Not much changed from yesterday; Bullish sentiment has continued to firm, but the reaction to CPI data on Thursday will be critical.

ES Market Structure Insights for Tomorrow

Yesterday I pointed out that the market was taking on a more bullish tone and had a good chance of heading to around the 3930 level. Today was confirmation of that; the weakest-hands buyers rallied the ES in the morning and were taken out of their positions in the early afternoon before the market rallied again into the close.

The structure on the way up is decent (though not excellent) and notably, value has steadily moved higher over the last 3 days. As I mentioned in the last two posts, CPI data coming out on Thursday is key. Tomorrow has a relatively high chance of being dominated by weak-hands momentum traders.

Potential Market-Moving Events Tomorrow

03:00am - FOMC Member Williams Speaks