ES Futures Daily Insights for Thu 10 Nov 2022

GDR Model picked up on some serious bearishness - the focus is now on CPI

GDR Model Insights for the Week

GDR Model Performance (2022): +26.28%

Market Tone: Bearish (previous week: Bearish)

Positioning: -50.00% Short (previous day: -50.00% Short)

Commentary: the GDR Model picked up on some serious Bearishness today. Ordinarily this would be concerning, but the CPI data coming out tomorrow can easily undo today’s move.

ES Market Structure Insights for Tomorrow

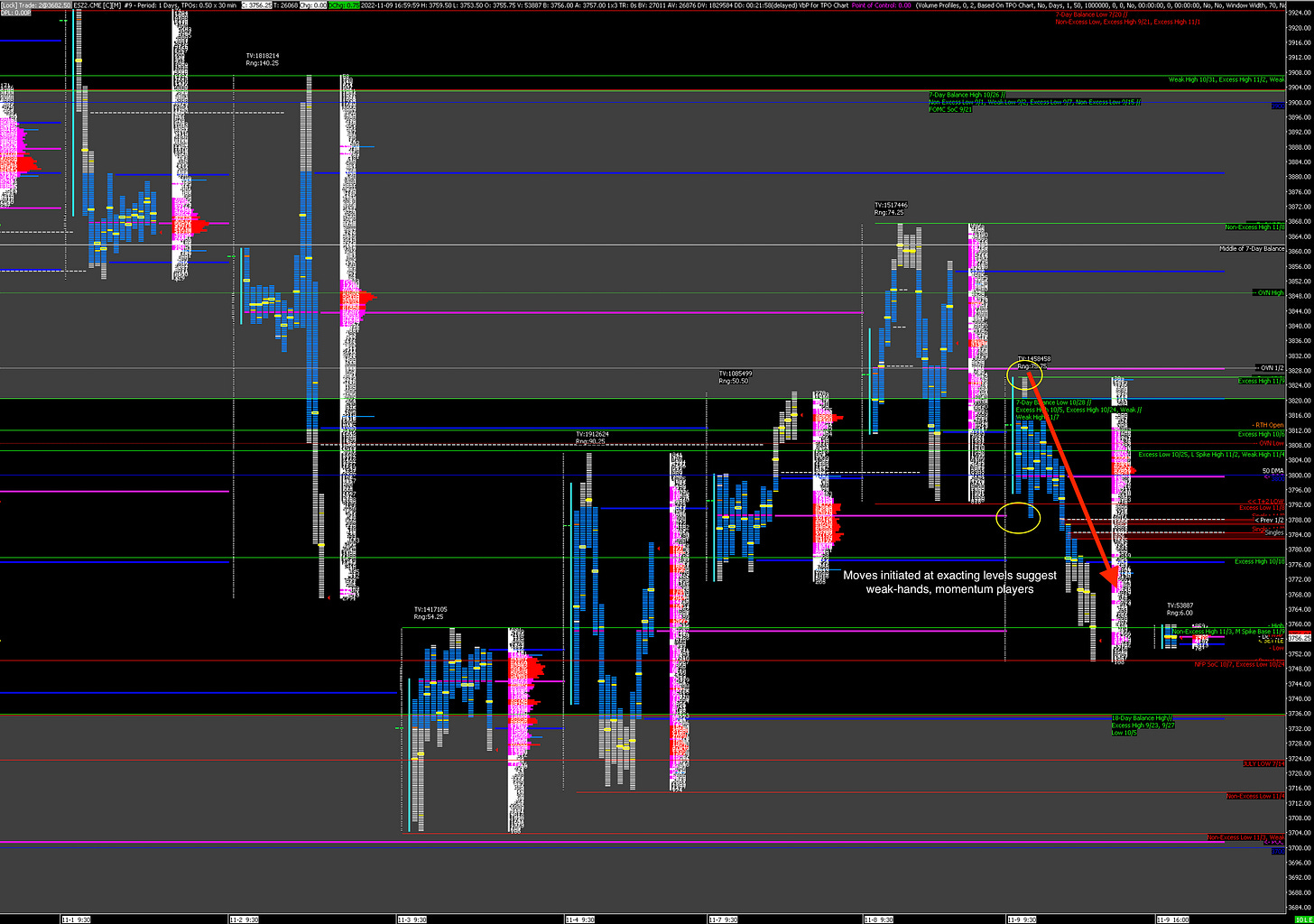

As expected, and as typical on days before major releases, today’s trade in the ES was dominated by weak-hands momentum players. The key to identifying this is to look for exacting levels. For instance, the move down from the day’s high set mid-morning started from just below yesterday’s POC and overnight halfback. Another example: for each 30-minute period for most of the day, the highs were set without violating the trend line marked by the red arrow in the chart above. This suggests momentum traders were waiting for that exact reference point to begin selling.

As of now we are back to no-man’s land after rejecting the Balance Zone above. Whichever Balance Zone gets accepted following tomorrow’s CPI data release has good odds of setting the prevailing trend for at least the next several upcoming trading sessions.

Potential Market-Moving Events Tomorrow

08:30am - CPI, Jobless Claims

12:30pm - FOMC Member Mester Speaks

01:30pm - FOMC Member George Speaks

02:00pm - Federal Budget Balance

06:35pm - FOMC Member Williams Speaks