ES Futures Daily Insights for Fri 11 Nov 2022

GDR Model looks set to go into Transition Mode next week after today's underlying bullishness

GDR Model Insights for the Week

GDR Model Performance (2022): +22.78%

Market Tone: Bearish (previous week: Bearish)

Positioning: -50.00% Short (previous day: -50.00% Short)

Commentary: as pointed out yesterday, CPI data could easily undo yesterday’s bearish move and it did. Barring any unexpected moves tomorrow, GDR Model will go into transition mode next week. Seasoned investors confident in a sustained shift in Market Tone may initiate starter positions during transition weeks.

ES Market Structure Insights for Tomorrow

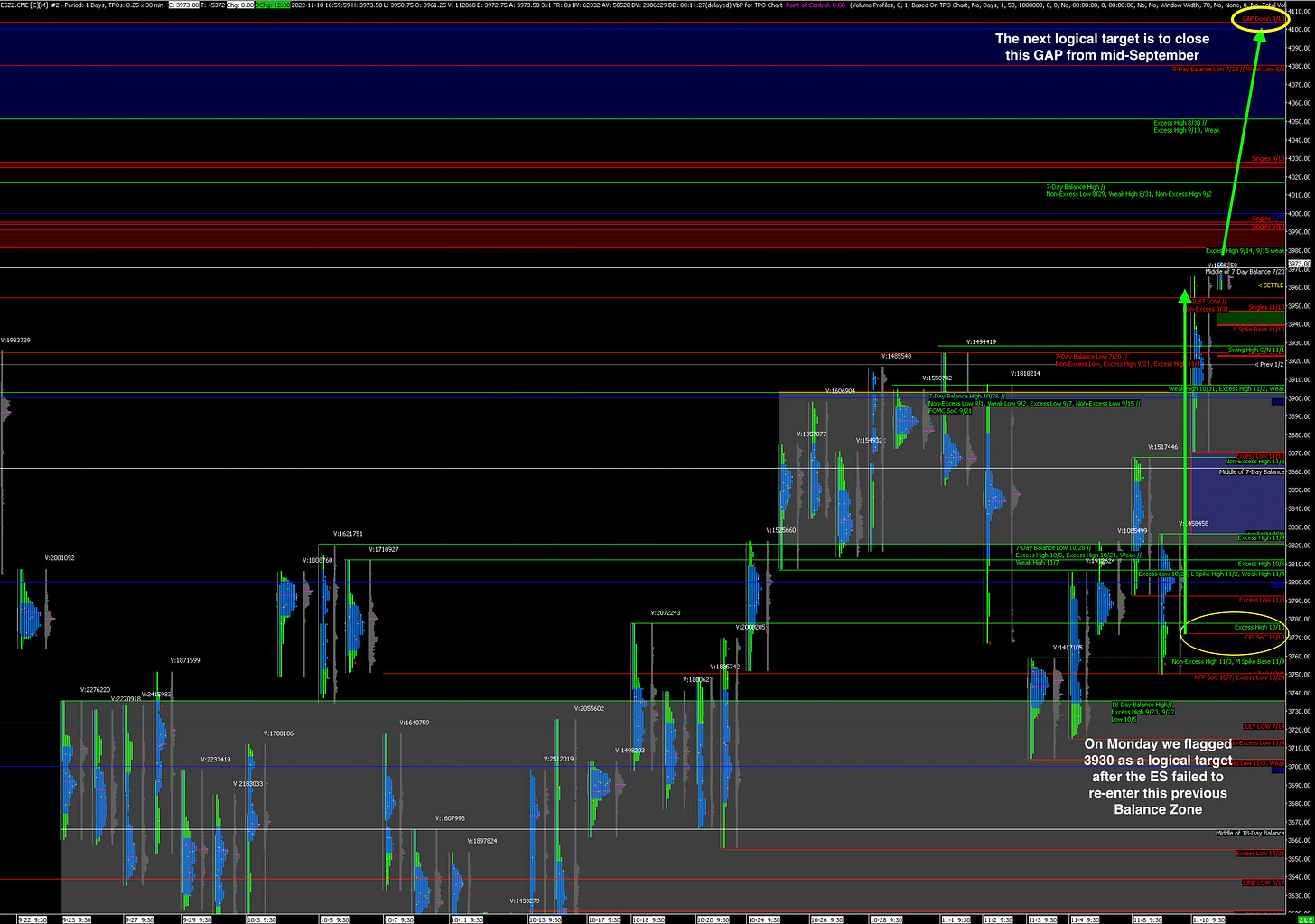

On Monday we flagged 3930 as a logical next target when the ES failed to re-enter the lower Balance Zone from September. On Tuesday, I tweeted a reminder that this idea was still in play:

Today was strongly Bullish following the CPI report opening on a large Gap; the ES first reached the expected 3930 level before correcting inventory briefly and continuing higher. While the structure left behind this move up isn’t flawless, it’s much better than the structure from the July rally. There is trapped short inventory below now and the next logical step is to take out poor structure above with an initial target at the top of the 9/13 Gap around 4105.

The ES now seems decisively bullish. Be careful in trying to fade it.

Potential Market-Moving Events Tomorrow

10:00am - Michigan Consumer Sentiment