2023 GDR Model Review

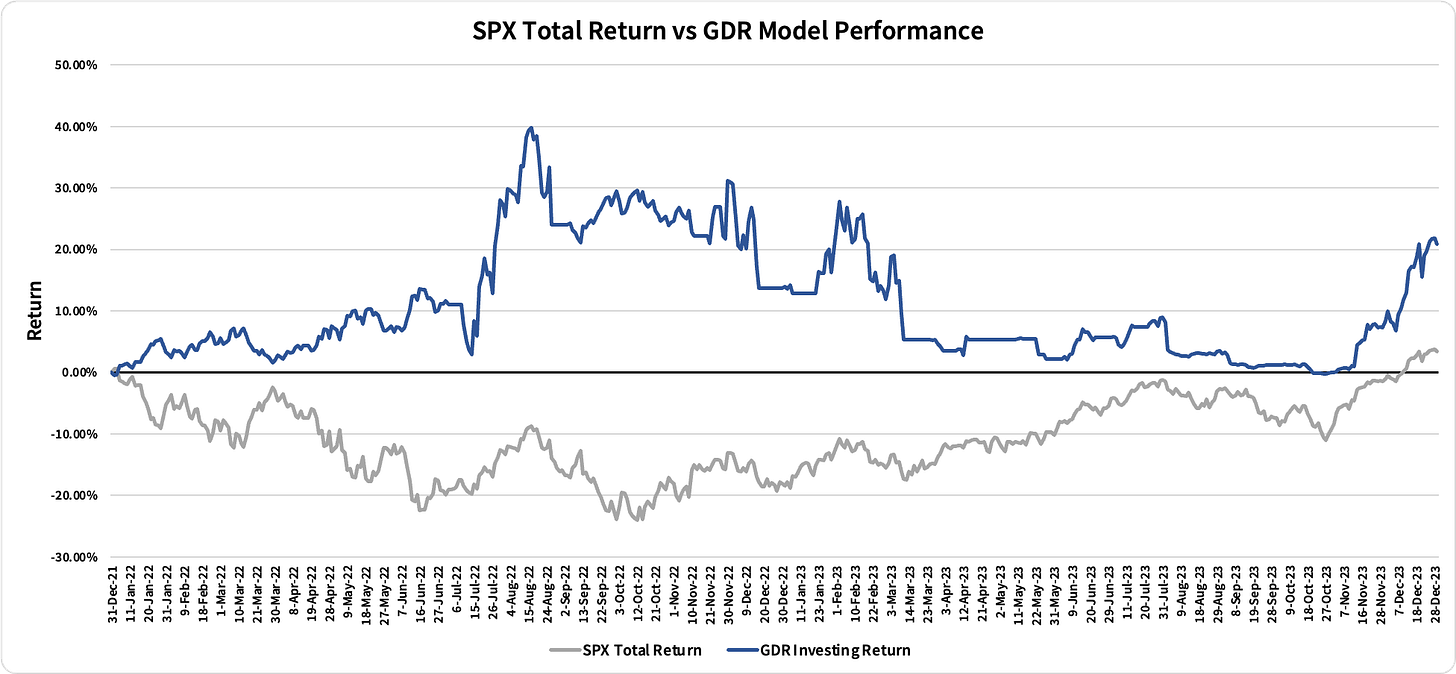

The GDR Model returned 6.22% vs the S&P 500’s Total Return of 26.29%. 2023 was challenging for the GDR Model’s style due to low confidence in the market at the start of the year.

First and foremost, before we review the year in depth and as stated in the GDR Performance Guarantee, if you have been on a paid subscription for more than 3 months and the GDR Model has a lower return than the S&P 500 Total Return index for the current calendar year as of 31 December, you will receive a 12-month Premium Subscription for free in the following calendar year. You won’t have to do anything as this will happen automatically.

Q1: A Promising Start to the Year

The GDR Model got off to a strong start to the year and by early February the model was up 12.32% vs the S&P 500’s Total Return of 8.98%. However, as the GDR Model thrives off of clear trends in the market, performance soon began to suffer as the market turned choppy for the rest of Q1.

The GDR Model returned -9.00% for Q1 compared with the S&P 500’s Total Return of 7.50%. It was clear that the model could benefit from some serious improvement.

Q2: GDR Model 2.0

The key weakness in the GDR Model exposed during Q1 was that it was not nimble enough in its positioning. To tackle this problem, the key improvement made for the model’s 2.0 version was to make it a multi-timeframe model, which was expressed through distinct Long-Term and Short-Term Outlooks. Breadth and Volatility Outlooks were also added to the model. The main goal in making the model multi-timeframe was to allow it more flexibility to shift positioning more promptly in response to changes in market strength.

The GDR Model returned 2.12% during Q2 compared with the S&P 500’s Total Return of 8.74%. The market remained choppy for most of Q2 before trending higher in June. GDR 2.0 was doing its job in not getting caught up in choppy markets and therefore reducing risk effectively. However, it was giving up too much in returns in the process, so I began work on GDR Model 3.0.

Q3: GDR Model 3.0

For July the GDR Model returned 3.11%, which was identical to the S&P 500’s Total Return of 3.21%. This is characteristic of GDR 2.0’s behavior: it looks to cap risk, but its main weakness was also clear: even though the market continued its uptrend in July, the model was too defensive to fully take advantage.

GDR Model 3.0 was released at the start of August. This is the current version of the model and by far the most fleshed out. The goal in this upgrade was to keep realized volatility (ex-post risk) low as in GDR 2.0, while also increasing the model’s expected returns.

The initial results were encouraging: the GDR Model returned -4.24% for Q3, slightly lower than the S&P 500’s Total Return of -3.27%. The timing of the implementation of GDR 3.0 was unfortunate as this more aggressive model came into effect almost exactly when the market shifted from an uptrend to a downtrend. This would make Q4’s results all the more important in measuring GDR 3.0’s effectiveness.

Q4: A Partial Recovery

At the start of Q4, the GDR Model’s Year-to-Date return was -11.01%, much lower than the S&P 500’s Total Return of 13.07%. This is a difference of 24.08 percentage points. However, for the last quarter of the year, the GDR Model returned 19.37%, which is considerably higher than the S&P 500’s Total Return of 11.69%. This allowed for partial recovery in the yearly returns, however, the GDR Model’s 2023 return was still 20.07 percentage points lower than its benchmark.

All in all, the GDR Model performed exactly as intended during Q4 following its upgrade to v3.0.

Conclusion

The GDR Model took 6 years to create and has now been running for a full 2 years. Despite the poor performance in 2023, this year turned out to be extremely productive as it exposed critical flaws in the model that I believe I was able to effectively address and fix.

The GDR Model’s return since it started running on 1 January 2022 is 20.81%, which, despite 2023’s challenges, is still well-above the S&P 500’s Total Return of 3.42% over the same period.

I look forward to what 2024 will bring. Happy New Year to everyone and thank you for your interest in the GDR Model!